COINBERG Crypto Fund

Portfolio Monitor

- Portfolio monitoring system

- Real time portfolio insights

- For fund managers

- For fund administrators

- Live crypto prices

- Live portfolio data

- Manual data feeding

- Live exposure monitor

- Automated NAV calculations

- Enhanced reporting

- Ex-ante exposure limit monitor

- Automated daily reconciliation

- Proactive alerts

- Charts

- Get in touch with us

COINBERG Crypto Fund Portfolio Monitor

Real time portfolio insights & historical reports

The Coinberg Crypto Fund Portfolio Monitor is a comprehensive portfolio monitoring system designed for crypto fund managers and administrators.

It provides real-time data and exposure insights, as well as accurate NAV calculations to streamline operations and enhance decision-making.

The system has been designed and developed continuously since 2018 by lumio labs.

It has been used daily by experienced crypto fund managers and is also utilized by APEX and Trident for reconciliation purposes.

The system is fully configurable to align with your fund's specific requirements.

For Fund Managers

A platform that is highly adaptable, ensuring it scales alongside your fund's unique needs

Real time crypto asset prices

Real time portfolio information from all major crypto exchanges, blockchains and crypto custodians

Real time exposure information and reports

Automated net asset value calculations

Easy and fast data reporting: historical balances, exposures, transactions, transfers, costs and fees

Ex ante exposure limit monitoring

Daily reconciliation of balances and transactions

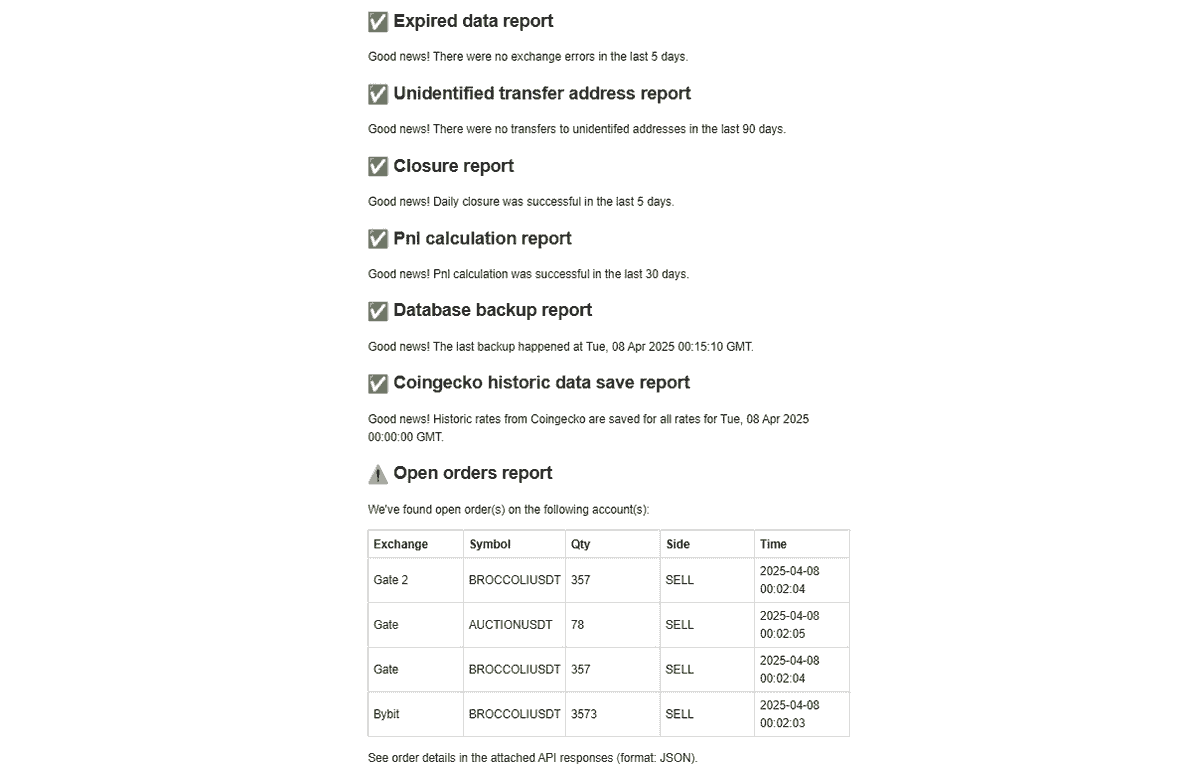

Automated alerts: open orders, unauthenticated transfers, missing data

Charts: selected fund information

For Fund Administrators

Fund balances, positions and transaction data from all major crypto exchanges

Download all balances and all transaction data in a standardized, easy-to-use format

Live crypto asset prices

Regular price updates from

- Coingecko

- and other sources as appropriate (e.g. Binance, Kraken, Pendle)

- in EUR and USD

manual balances

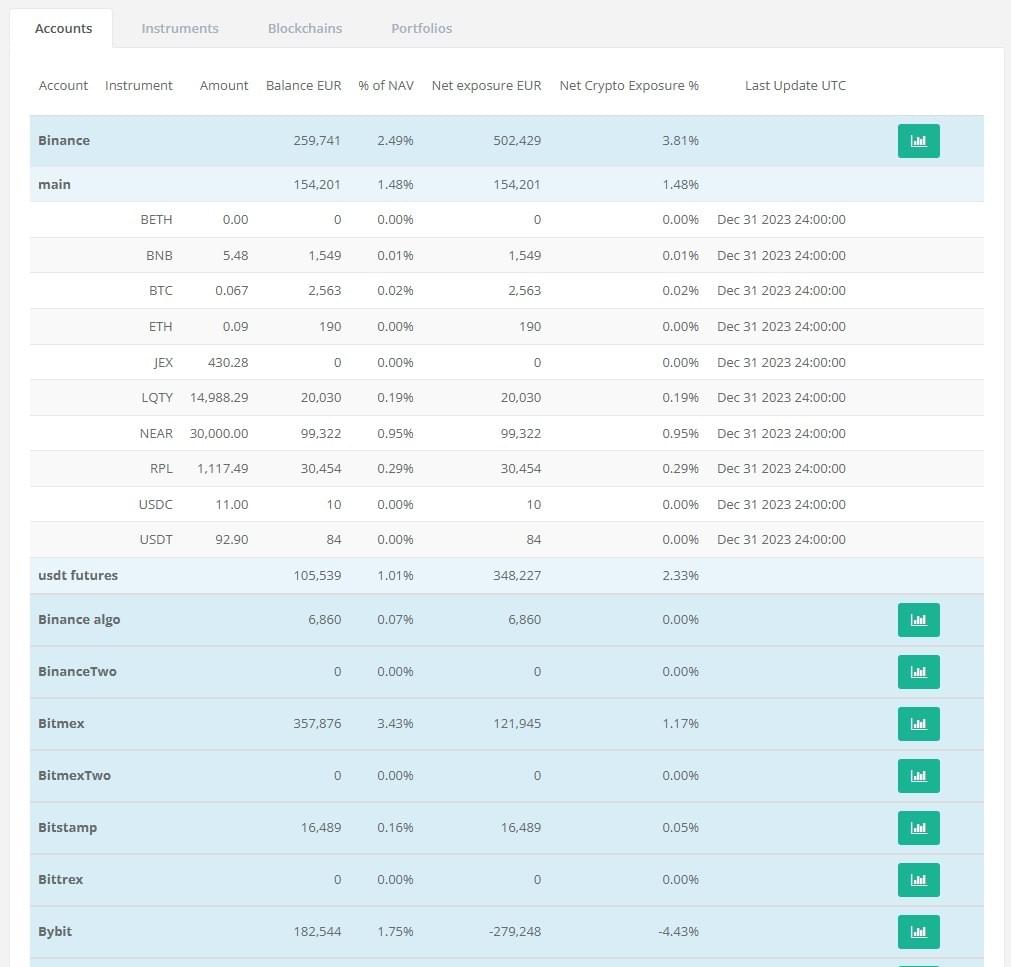

Live portfolio information from all major crypto exchanges, blockchains, crypto custodians and service providers

Balances, positions, UPLs, exposures (updated hourly)

Binance, Bitget, Bitmex, Bitstamp, Bittrex, Bybit, Coinbase, Deribit, Gate.io, Hyperliquid, Kraken, Kraken futures, Okex

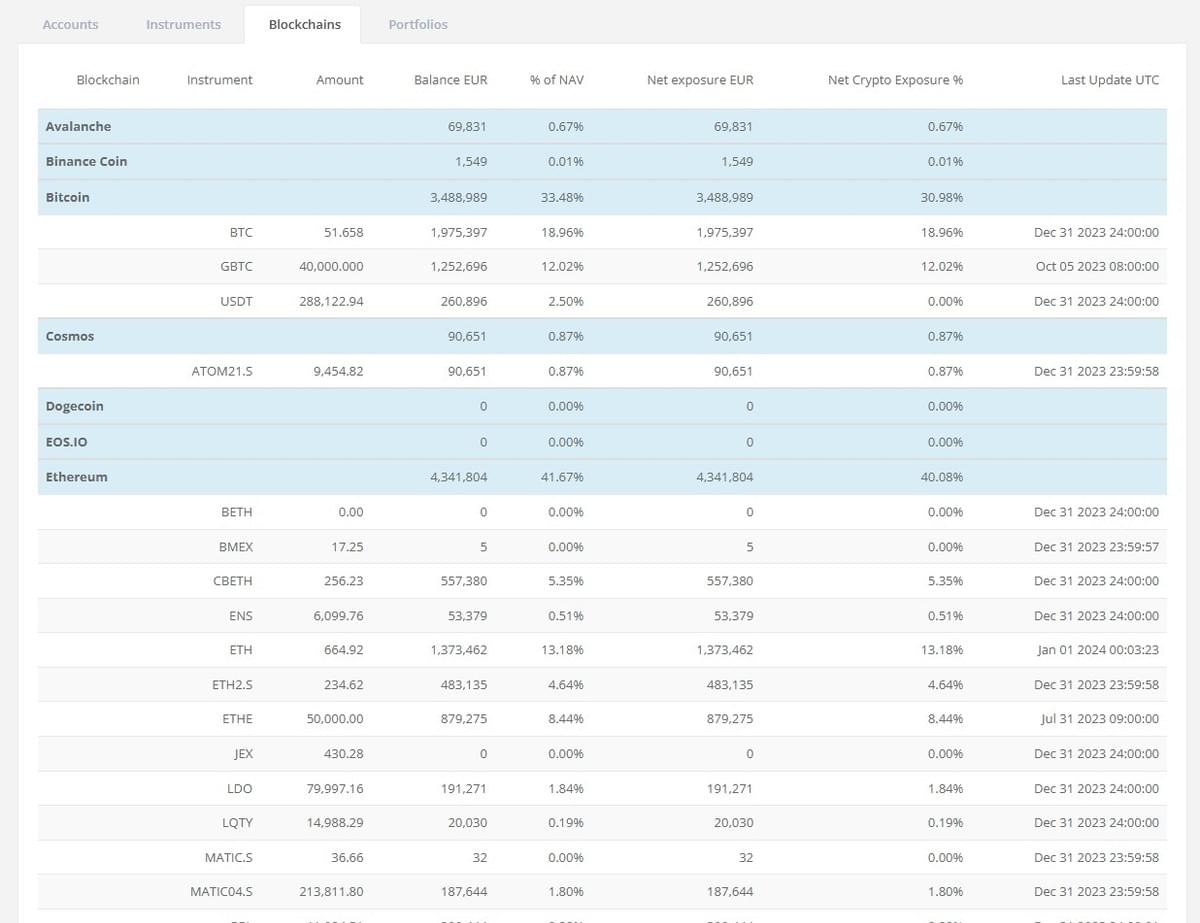

Bitcoin & Ethereum blockchains (incl. ERC-20 tokens), Arbitrum, Rocket Pool & Beaconchain

Fireblocks

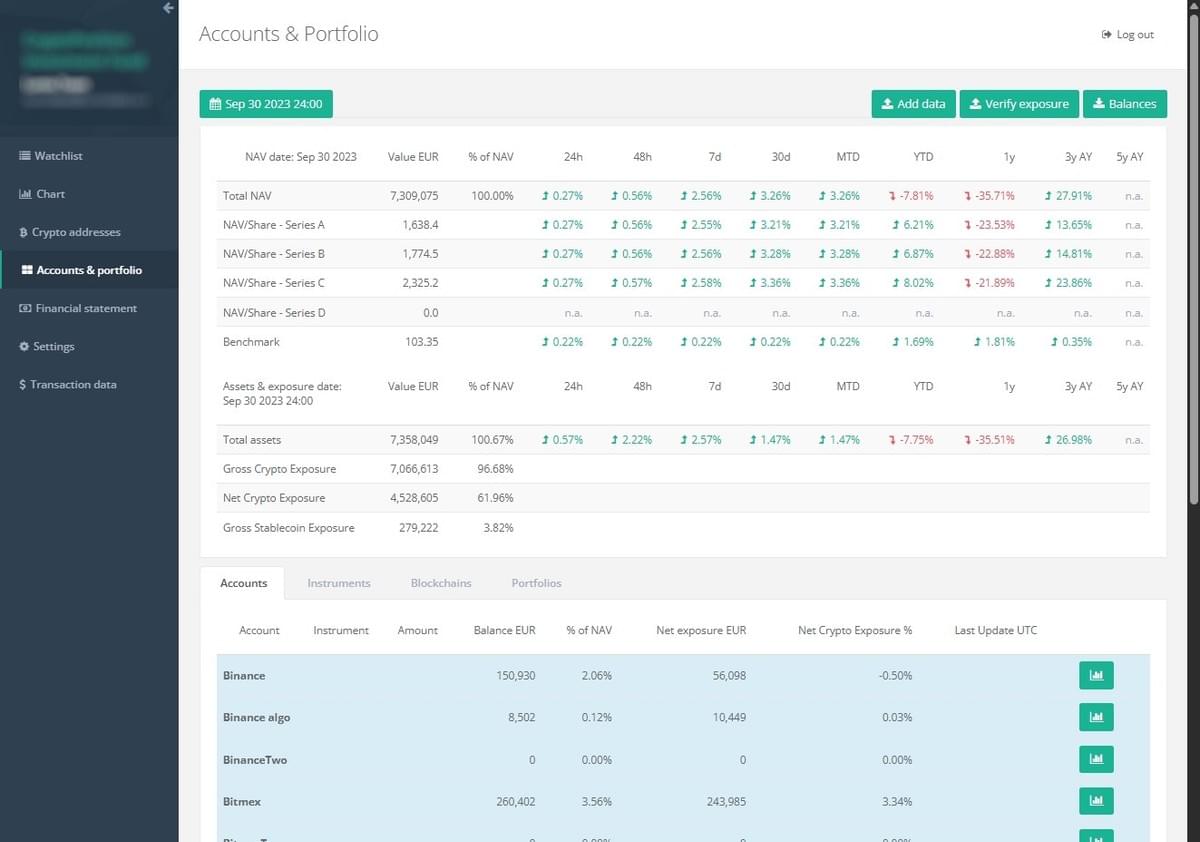

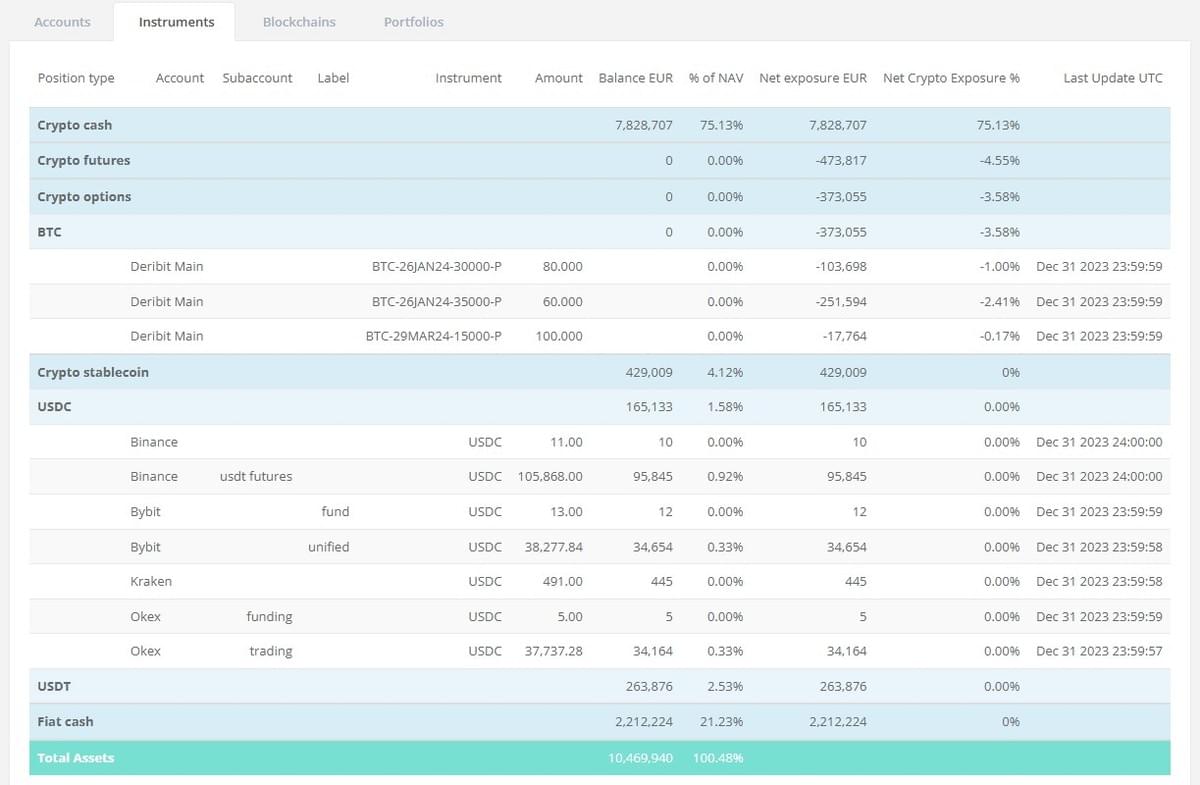

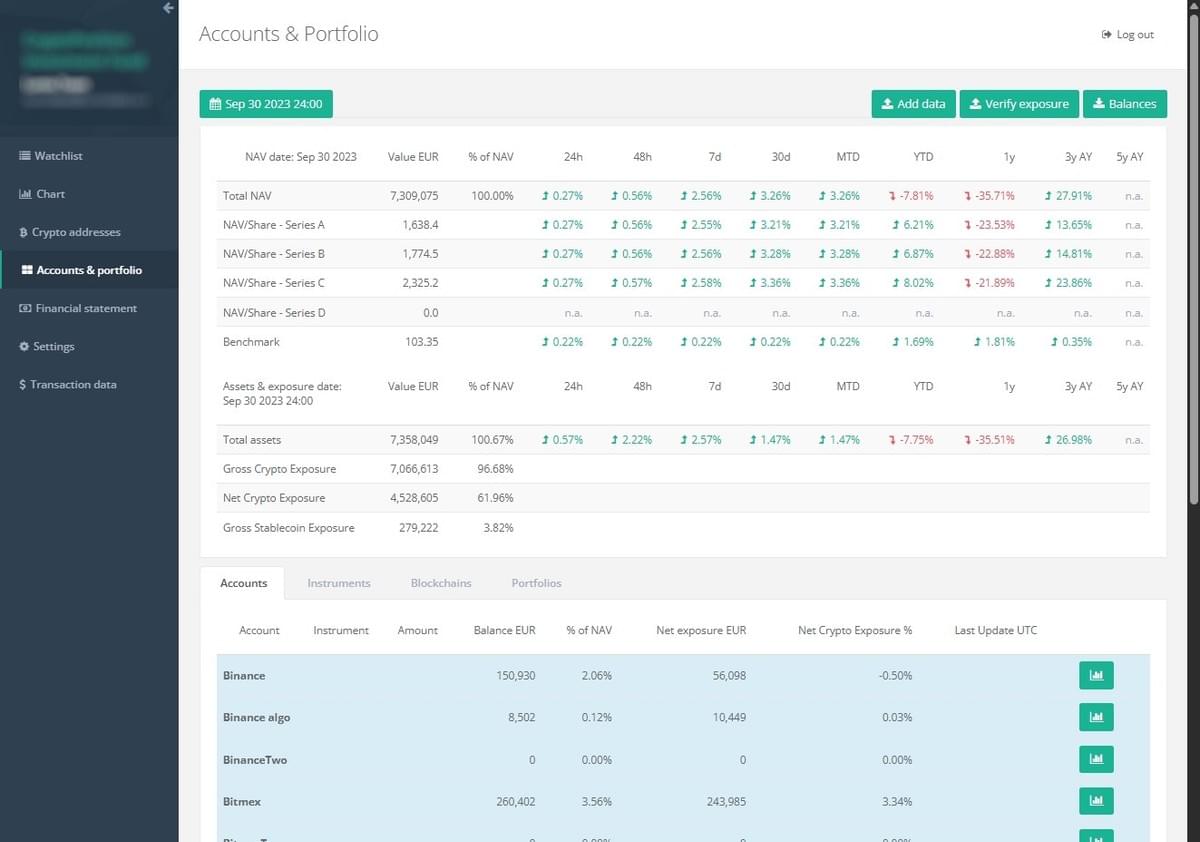

Live and historical (hourly) reports by Accounts, Instrument types and instruments, Blockchains or Individual portfolios

reports by accounts

reports by instrument types and instruments

reports by blockchains

reports by individual portfolios

Manual data feeding for accounts without a proper API

Flexible data input for bank accounts, technical accounts (e.g. claims against third parties), pending transactions

manual balances

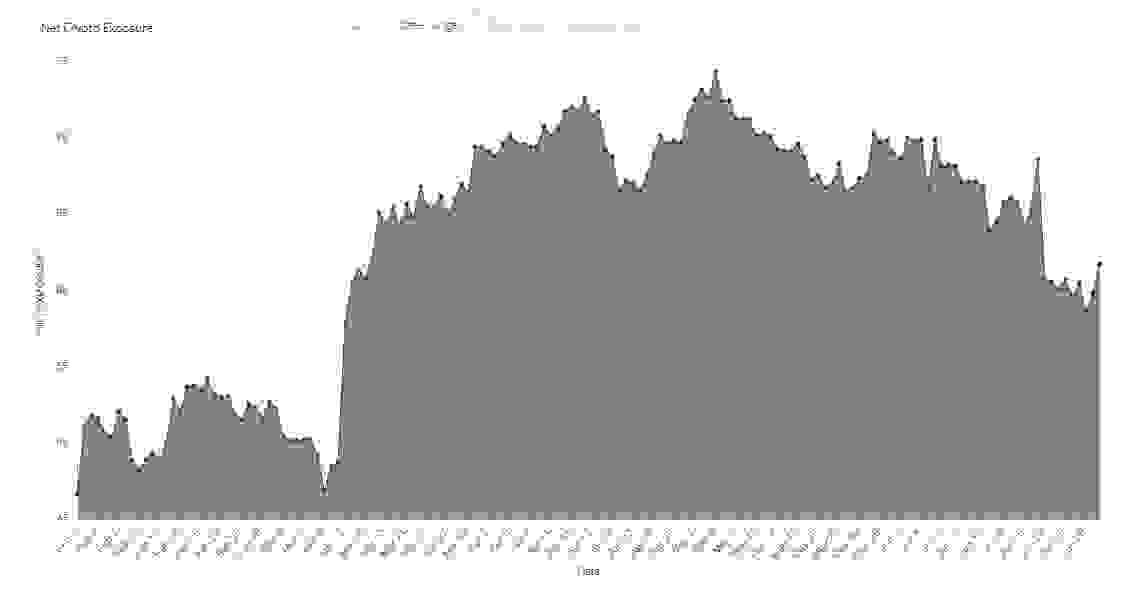

Live exposure monitor & historical reports

Gross and net crypto and stablecoin exposure of the fund

Detailed information on individual position exposures

Exposures by accounts, instruments, blockchains and individual portfolios

Updated every five minutes (in accordance with price and balance updates)

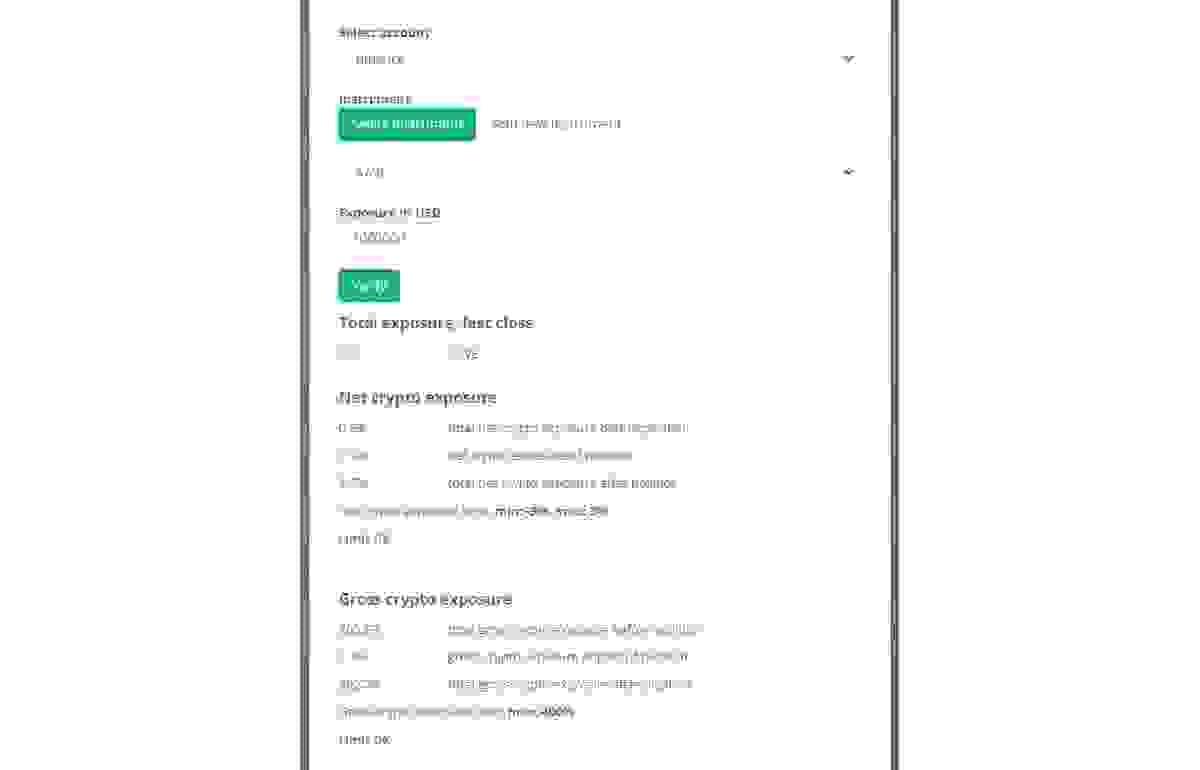

Ex-ante exposure limit monitor (see below)

Summary reports on total fund exposures

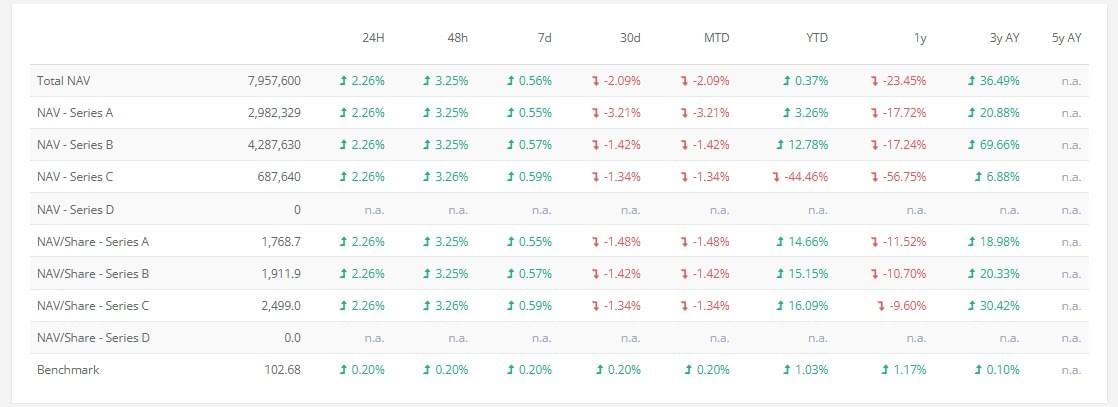

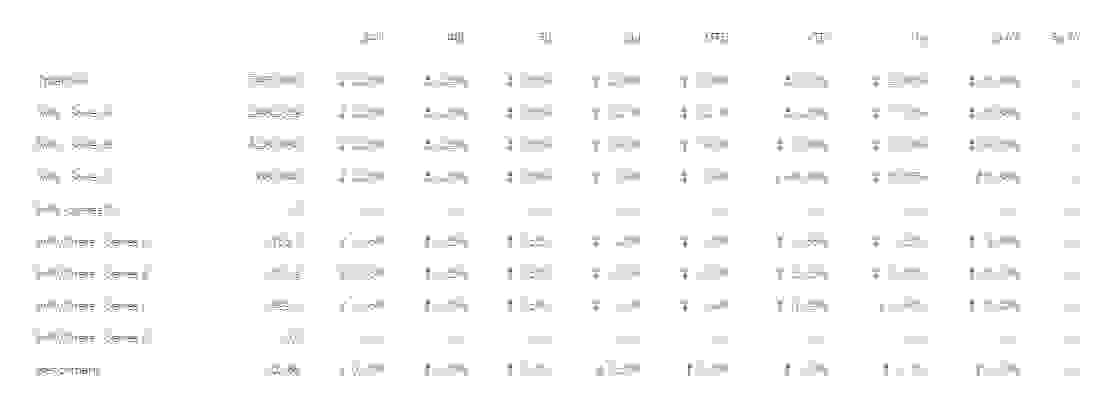

Automated net asset value calculation

Benefit from automated NAV calculations, including operating expenses, management fees, and performance fees, with adjustable settlement periods.

For fund management purposes (non-official reports)

- Incl. operating expenses, management fees and performance fees

- Incl. manually recorded or automated benchmark records

- Incl. manually recorded subscriptions and redemptions

- Incl. manually recorded operating fees and expenses

- Adjustable NAV-calculation and performance fee settlement periods (e.g. daily, monthly, quarterly, sixmonthly, annual)

Enhanced reporting

Easily generate and download historical data for balances, transfers, and NAV calculations.

For fund management purposes (non-official information)

- Historical balances (hourly)

- Transfers (incl. internal transfers between subaccounts)

- Spot, futures, perp, option transactions

- Settlements, funding proceeds, lending and borrowing transactions

- Staking transactions and staking rewards

- NAV-calculations, fees and expenses, accrued liabilities

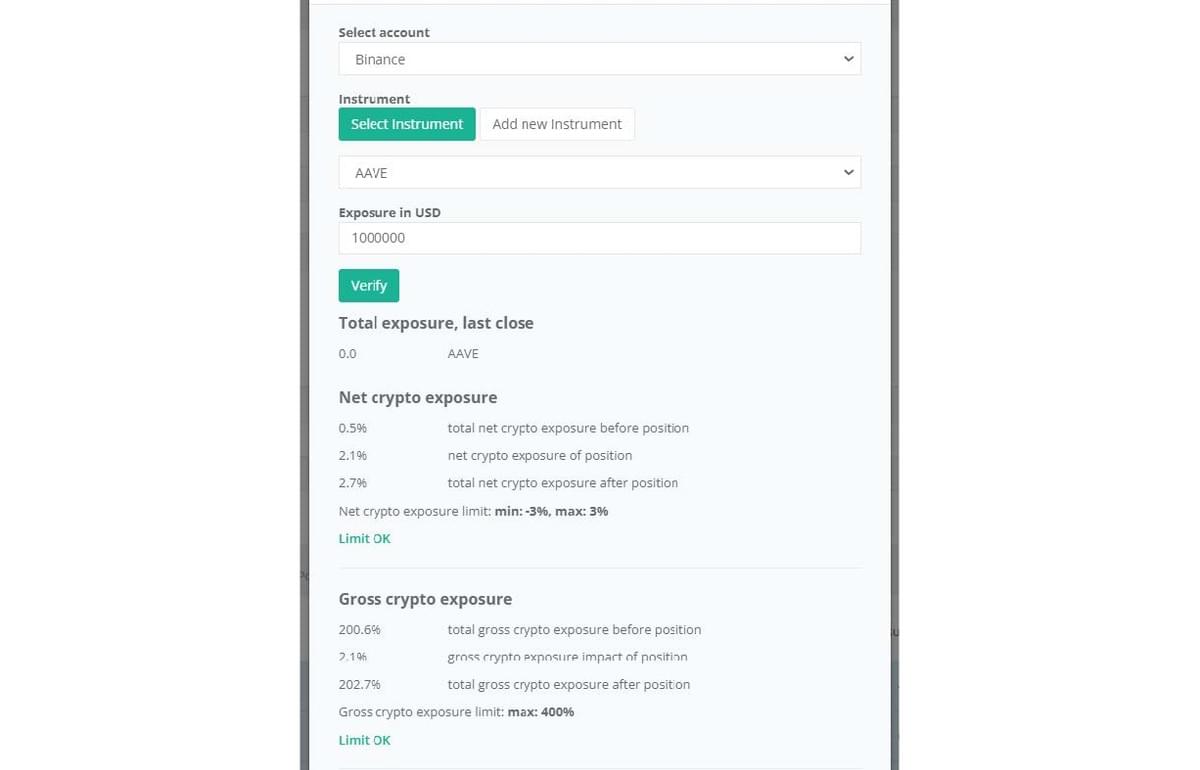

Ex-ante exposure limit monitor

For fund management purposes (non-official information)

- Verification of pre-determined fund limits

- E.g. gross and net crypto exposures

- Monthly verification reports

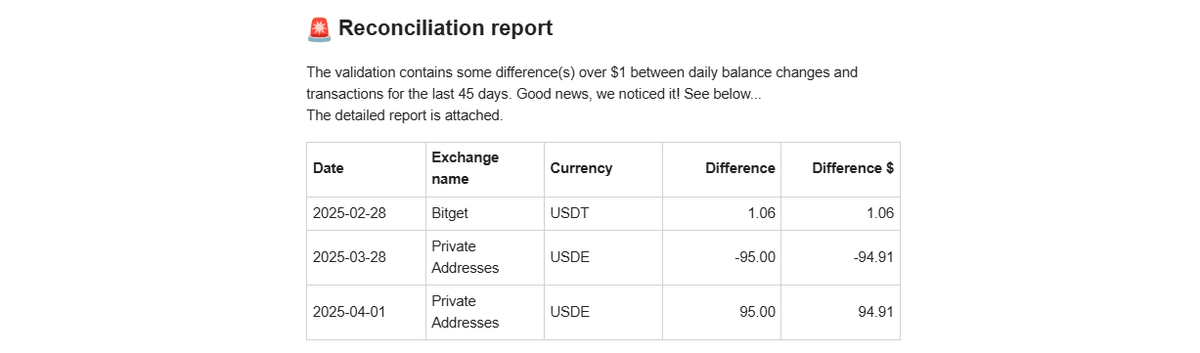

Automated daily reconciliation of balances and transactions

Daily reconciliation of all balance and position data against transfers, transactions, fees, PNLs, proceeds, rewards, airdrops, etc.

Automated reconciliation report emails daily in the morning

Proactive alerts

Automated notifications for open orders, unauthenticated transfers, missing data, and many other.

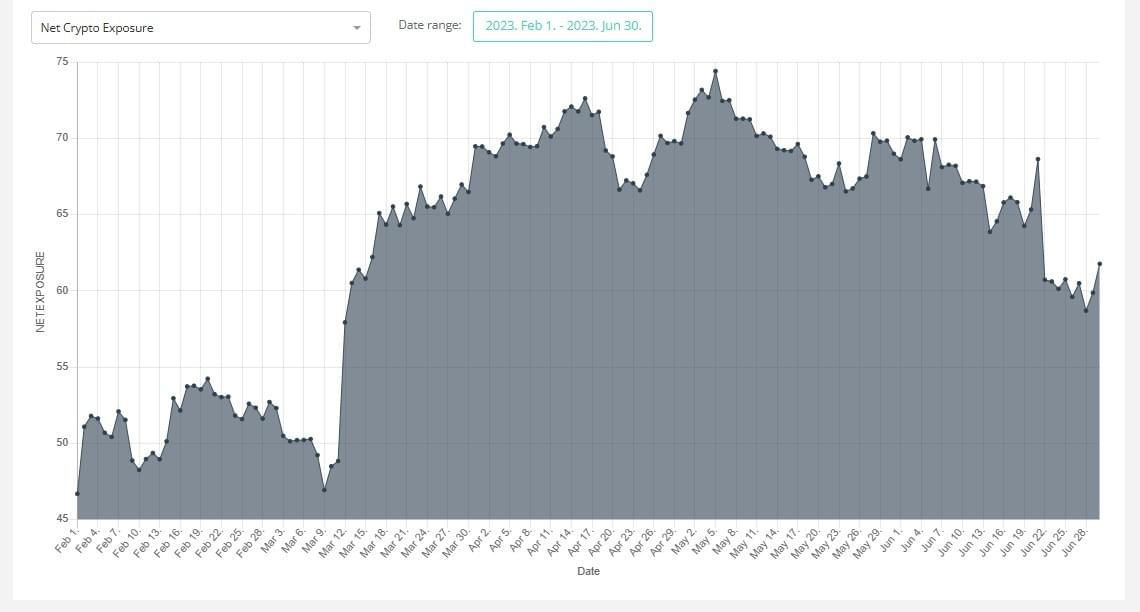

Charts

Charts on key fund information

- Assets

- Gross and net exposures

- NAV and NAV/share

net crypto exposure

Get in touch with us

As custom software developers at lumio labs, we've been designing and developing the system for actual crypto funds who have been daily users for 8+ years now.

Let us know about your crypto fund.

We’ll take all fund monitoring tasks off your shoulders.

Schedule a demo with us!

managing director, business development

25+ years of experience in corporate finance, business development, management and investments;

extensive experience in large size, complex projects

managing director, software development

software developer with 20+ years of experience, degree also in business administration and economics

Python, JS, C#, complex software systems (incl. ERP systems)

Schedule a demo with us at lumiolabs@lumiolabs.io